The #1 Software Suite for Your Toy Store

Maximize Sales Across Multiple Channels

BridgeERP allows you to maximize sales across multiple channels, and keep your customers happy with rewards and discounts. Combined with seamless inventory tracking and easy invoicing, it's the perfect solution for your toy store!

Everything Your Toy Store Needs to Thrive

Product Management

Manage thousands of products with flexible configurations for sizes, colors, and variants. Perfect for toys of all shapes and sizes.

Point of Sale

Intuitive POS interface with barcode scanning, discounts, loyalty programs, and multi-payment options for seamless checkout.

Online Store

Create beautiful product pages with drag-and-drop builder. Integrate seamlessly with your physical store operations.

Complete Toy Store Management System

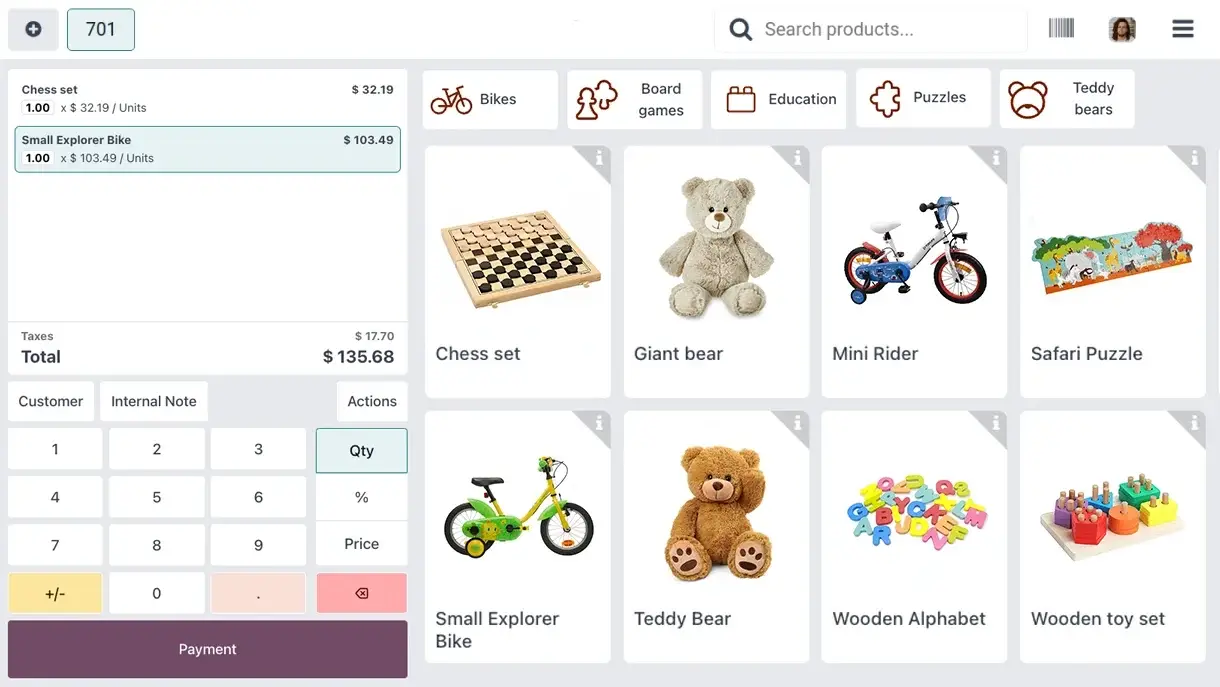

Intuitive Point of Sale Interface

Play with our user-friendly POS designed specifically for toy stores. Fast checkout, inventory sync, and customer management all in one place.

Explore POS →

Thousands of Products? No Worry!

Flexible product configuration for toys in all shapes and colors. Showcase variety by configuring sizes, colors, and other variants effortlessly.

Learn More →

Build Your Perfect Online Store

Create a magical online presence with our website builder. Design sleek product pages by simply dragging and dropping building blocks.

Get Started →Comprehensive Business Modules

Accounting

Powerful accounting module tailored for toy stores. Track income, expenses, taxes, and profitability in real-time with automated journal entries.

Discover MorePoint of Sale

Speed and ease at checkout with barcode scanning, discounts, loyalty programs, and multi-payment options—online and offline.

Explore MoreInventory and Purchase

Real-time inventory tracking, automated reordering, multi-location warehouses, and intelligent forecasting tools.

Learn MoreE-Commerce

Integrated online store with seamless synchronization between physical and digital sales channels.

Get StartedPayment Processing

Accept all payment methods: cash, mobile money, credit cards, and electronic payments—both in-store and online.

View OptionsShipping Integration

Partner with local and global couriers for seamless product delivery. Click and collect options available.

Learn MoreCompatible with All Devices

Multi-Device Support

Works seamlessly across tablets, laptops, desktops, and industrial machines. Sync effortlessly with barcode scanners and scales.

Multiple Cashiers

Manage multiple cashier accounts and secure them with badges or PIN codes for enhanced security.

Click and Collect

Allow customers to shop online and pick up their orders in-store for ultimate convenience.

Inventory Scanning

Use multiple phones or barcode scanners to quickly count your inventory with real-time updates.

African Tax Compliance Ready

Integrated with major African tax systems for seamless compliance

Kenya

Integrated with eTIMS by KRA for real-time invoice reporting and compliance.

Uganda

Compatible with EFRIS by URA for electronic invoice generation and submission.

Rwanda

Aligns with EIS by RRA for real-time electronic invoice issuance and reporting.

Tanzania

Supports EFDMS by TRA for electronic fiscal device management.

Ghana

Integrates with E-VAT system by GRA with real-time transaction reporting.

South Africa

Supports SARS e-invoicing with digital signatures and archiving.

Ready to Transform Your Toy Store?

Join thousands of toy store owners who trust BridgeERP to manage their operations and maximize their sales with our comprehensive solution.