The #1 Software for Furniture Stores

Handle everything from e-Commerce and Point of Sale transactions to custom furniture orders. BridgeERP is a complete solution for managing your store's B2B and B2C sales.

All-in-One Furniture Business Solution

From showroom displays to custom orders, manage every aspect of your furniture business with comprehensive tools designed for furniture retailers.

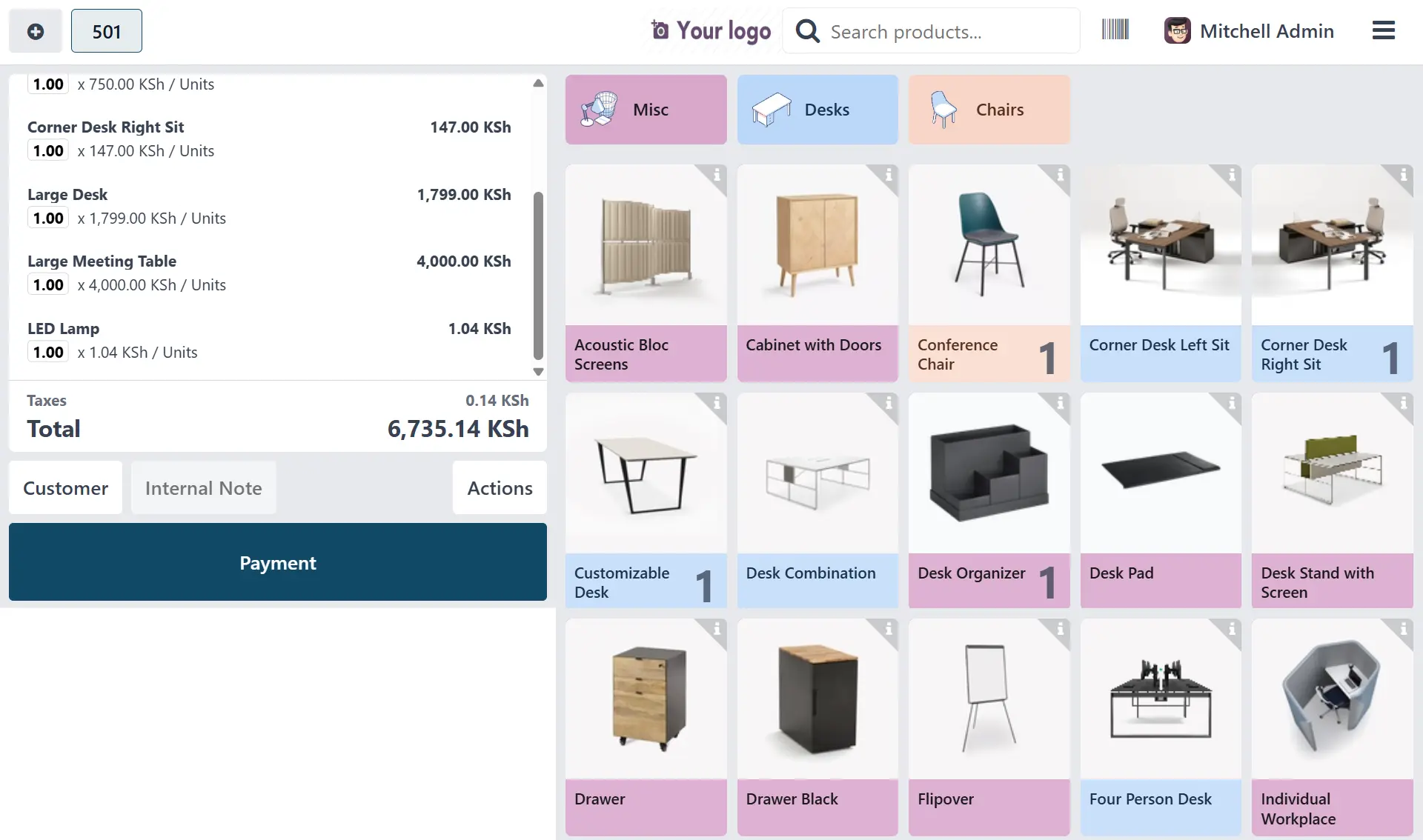

Smart In-Store Checkout and Bundle Furniture

Product kits allow you to bundle furniture sets and sell entire set at once. Pay now, ship later! For bulky items, select delivery dates at checkout to automatically generate delivery orders.

- Room set bundling

- Scheduled delivery options

- Bulky item handling

- Payment before delivery

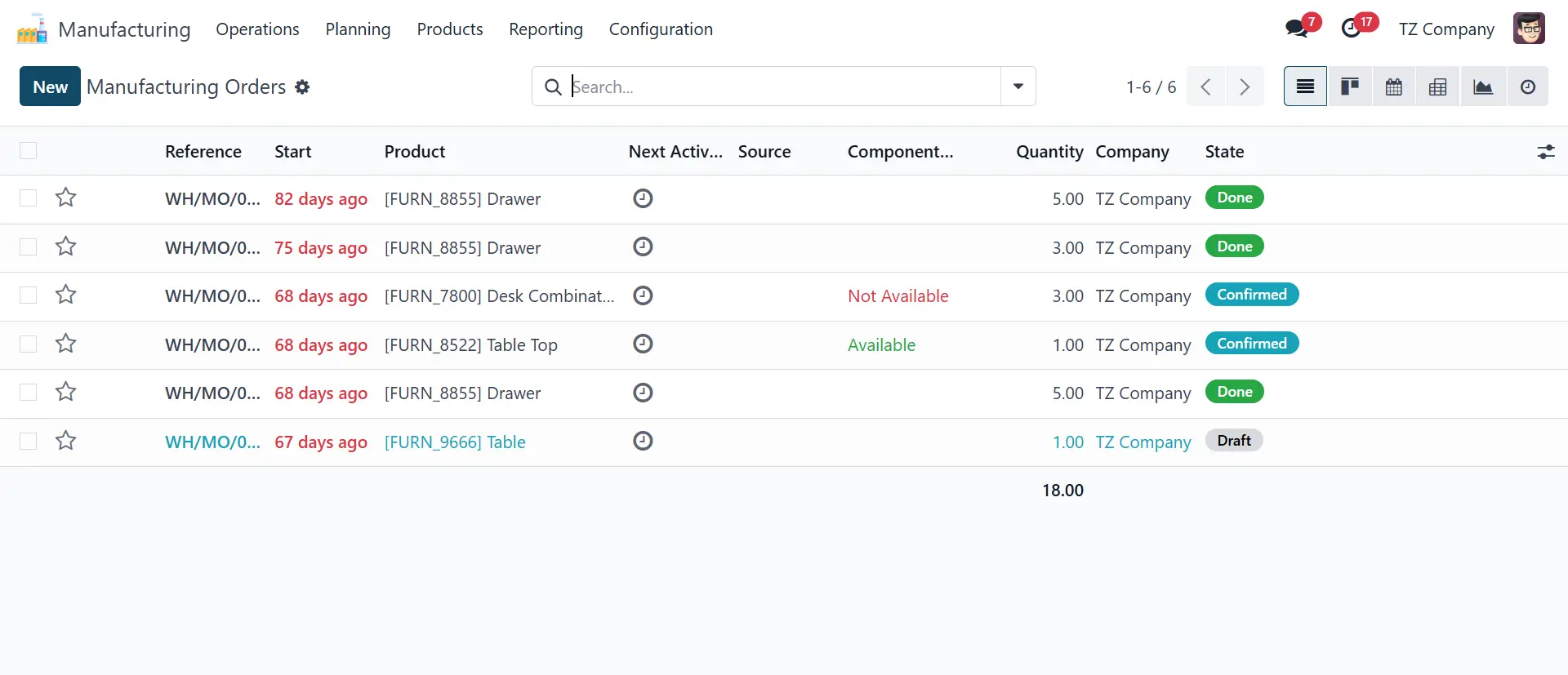

Custom Orders and Make-to-Order Manufacturing

No worries with custom orders! Smart sourcing automatically generates purchase orders based on your sales. Make-to-order custom items in-house and track production with integrated manufacturing tools.

- Smart sourcing automation

- Make-to-order production

- Custom specifications tracking

- Production timeline management

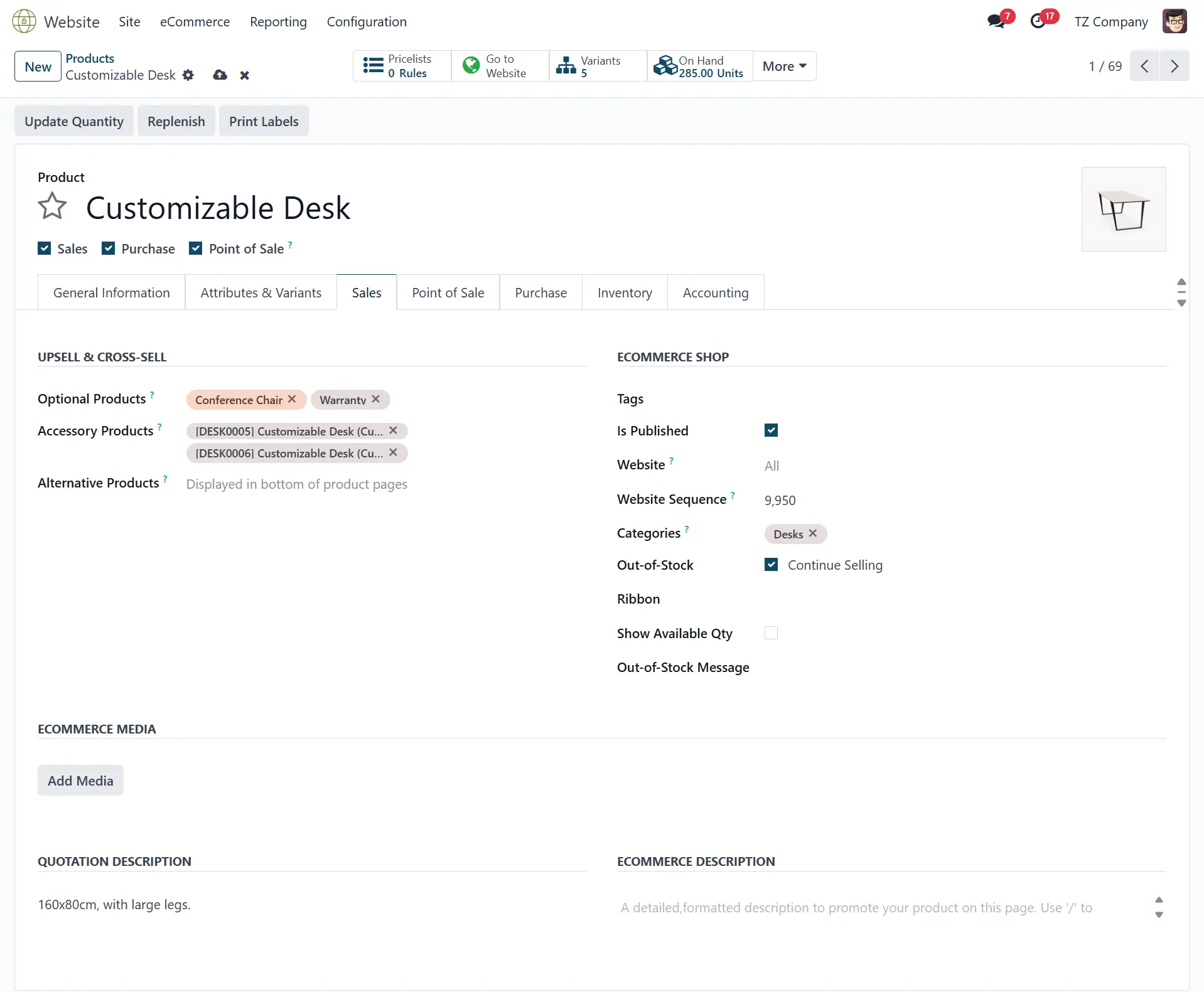

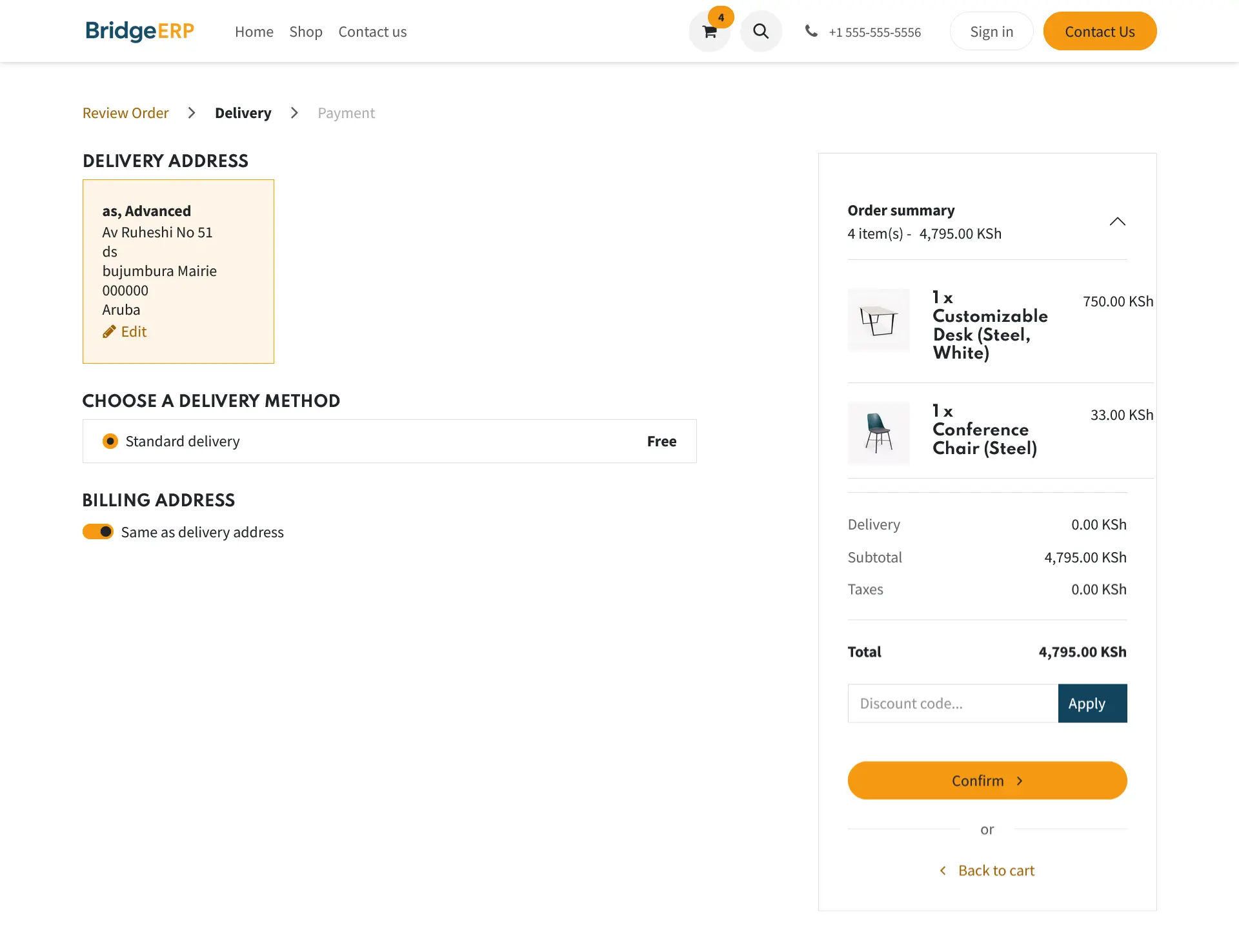

Complete Furniture E-Commerce Platform

Beautiful online showroom with 360° product views, room visualizers, and comprehensive product catalogs. Handle both B2B trade orders and B2C consumer sales seamlessly.

- 360° product photography

- Room visualization tools

- B2B and B2C pricing

- Trade customer portals

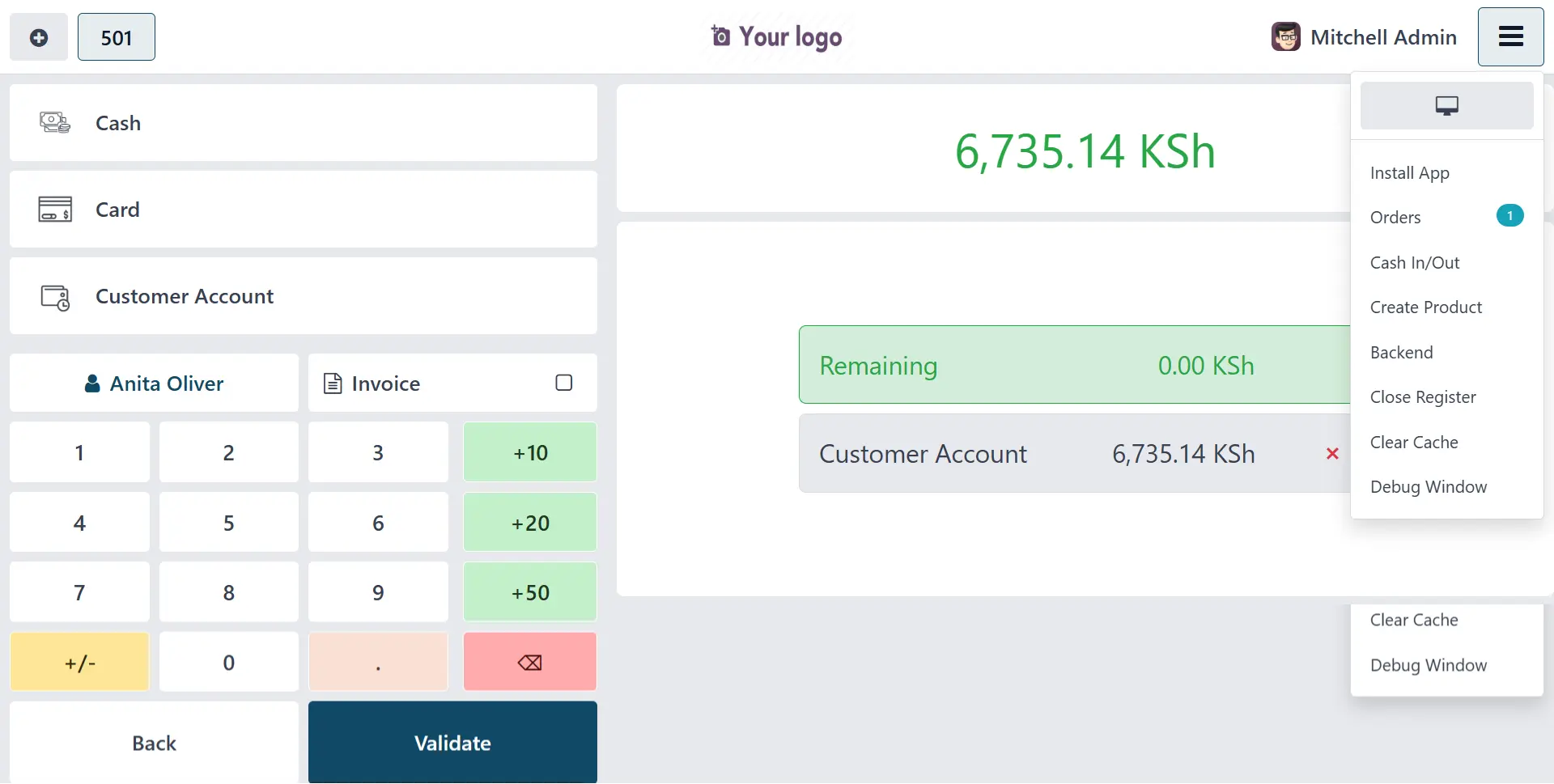

Furniture-Specialized POS System

Designed for furniture retail with room planners, financing options, and delivery scheduling. Handle large transactions, multiple payment plans, and customer deposits with ease.

- Room planning integration

- Financing and payment plans

- Deposit management

- Delivery coordination

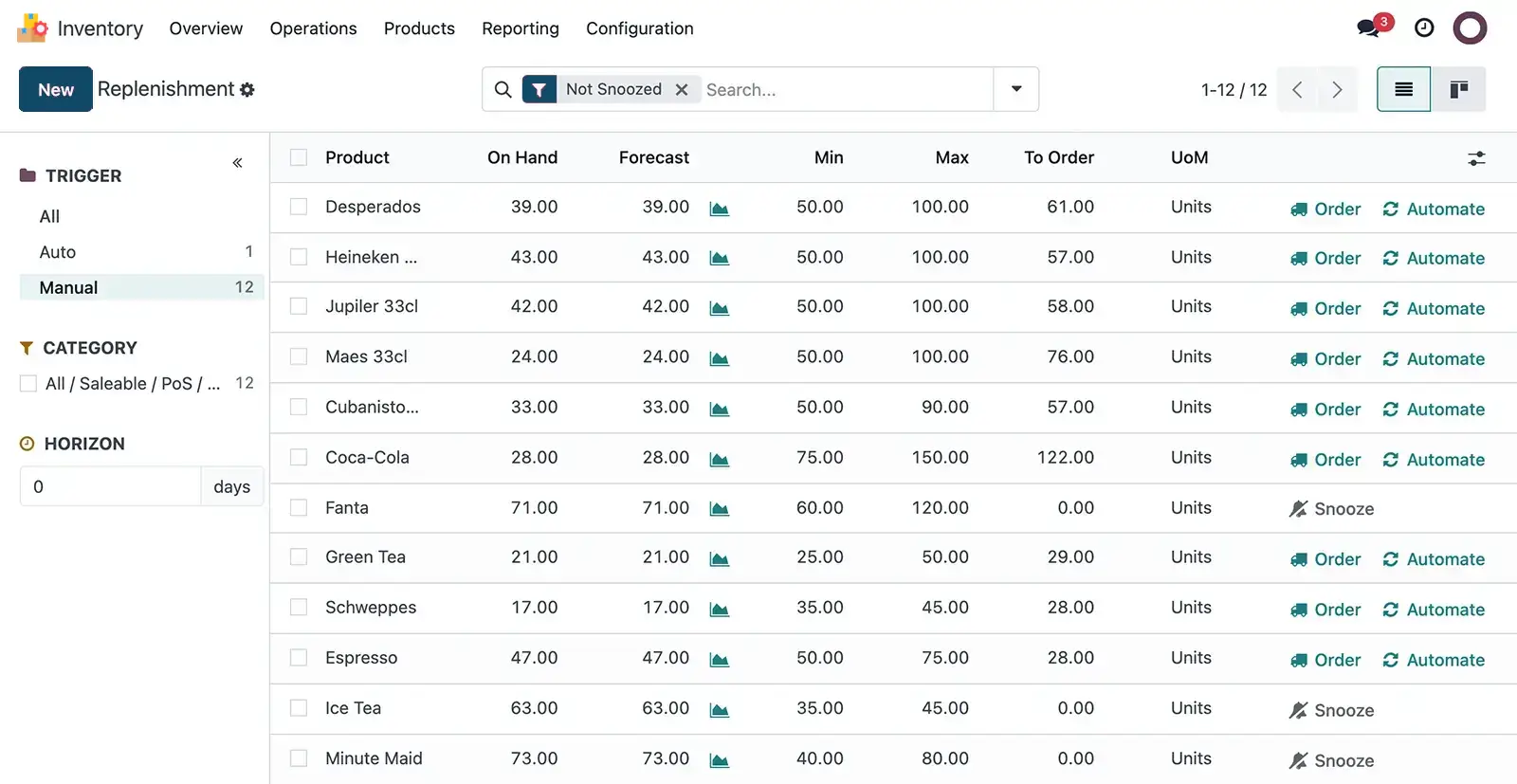

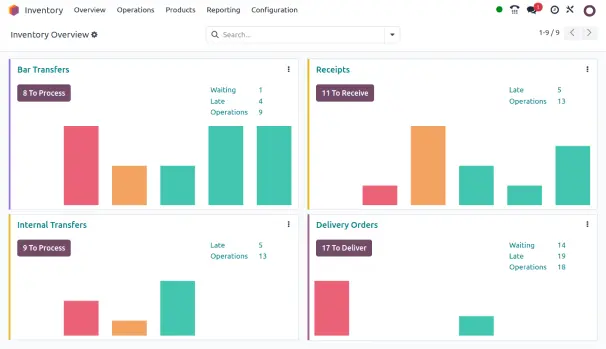

Advanced Furniture Inventory Management

Track large furniture items across multiple warehouses and showrooms. Handle floor samples, incoming shipments, and coordinate with manufacturers for special orders and custom pieces.

- Multi-warehouse tracking

- Floor sample management

- Manufacturer coordination

- Special order tracking

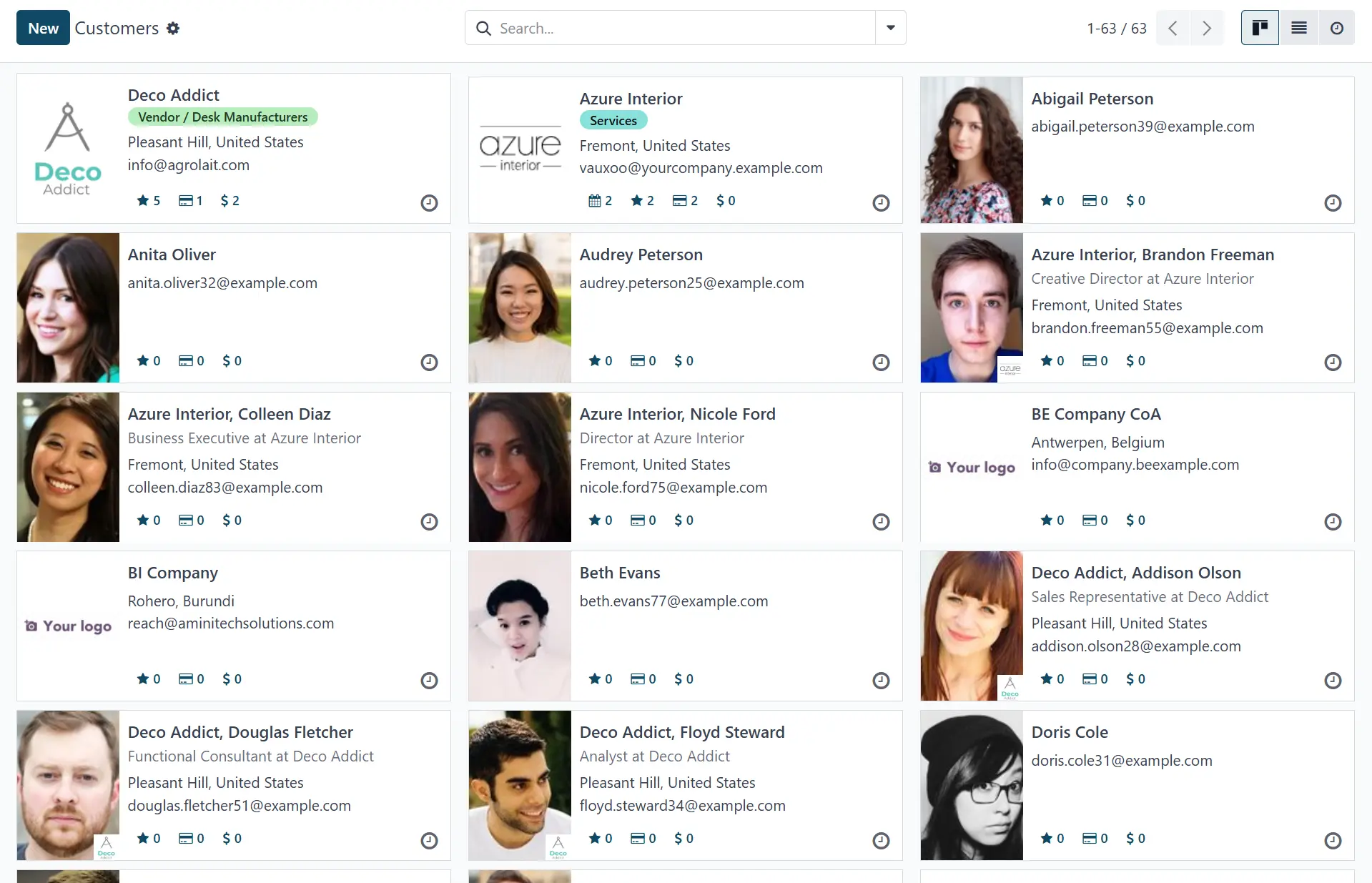

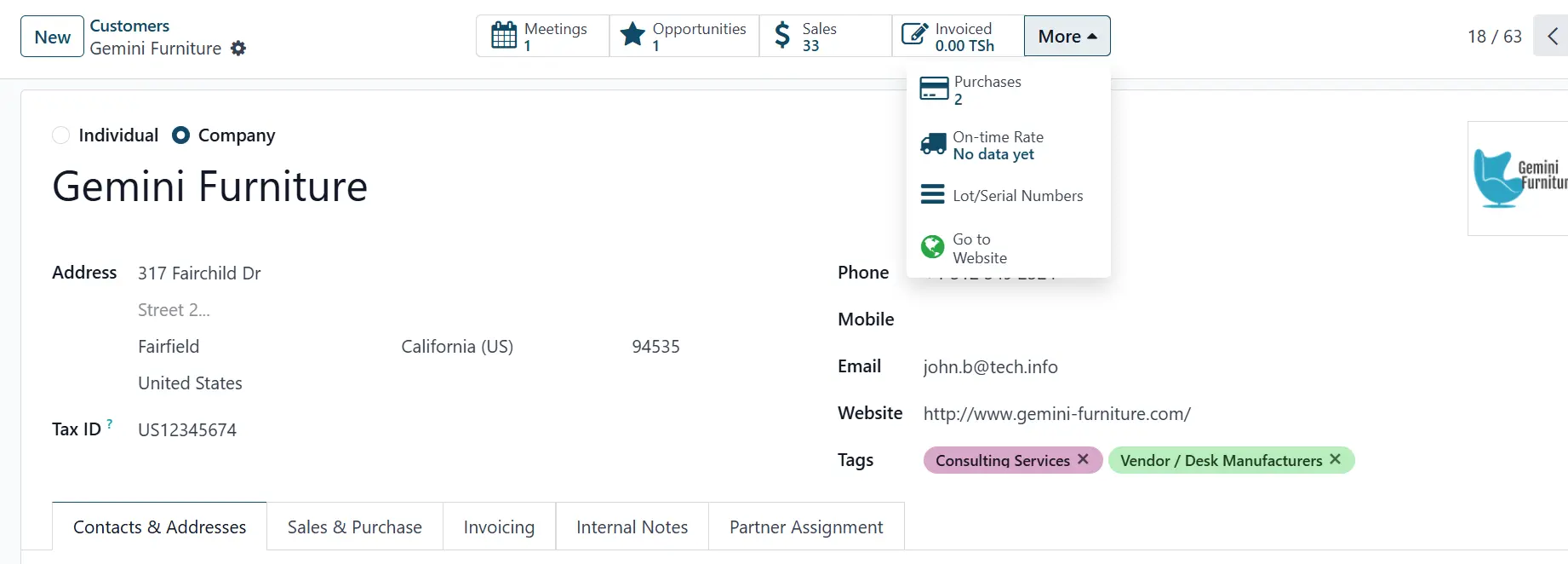

B2B and B2C Customer Management

Manage both trade customers and consumers with specialized tools. Track design preferences, delivery addresses, and payment terms. Handle interior designers, contractors, and retail customers.

- Trade customer accounts

- Design preference tracking

- Multiple delivery addresses

- Credit terms management

Furniture Business Financial Management

Specialized accounting for furniture retail with project-based costing, delivery tracking, and manufacturer payment management. Handle deposits, final payments, and warranty tracking.

- Project-based accounting

- Deposit and payment tracking

- Manufacturer invoicing

- Warranty management

Everything Your Furniture Business Needs

Multi-Device Compatible

Works seamlessly across tablets, laptops, and showroom displays

Professional Website

Beautiful furniture catalog website for online sales and orders

Multiple Staff Support

Manage sales staff, designers, and warehouse teams with role-based access

Click and Collect Orders

Allow customers to order online and coordinate showroom pickup

All Payment Methods

Accept cash, cards, financing, layaway, and trade accounts

Delivery Management

Coordinate white-glove delivery and assembly services

Mobile Inventory

Track large furniture items with mobile devices and scanning

Room Planning Tools

Help customers visualize furniture in their space with planning tools

Sales Analytics

Track bestselling items, seasonal trends, and showroom performance

Assembly Services

Manage furniture assembly and installation service scheduling

Special Orders

Handle custom specifications and special manufacturer requests

Design Services

Coordinate with interior designers and track design projects

Regional Tax Compliance Across Africa

Stay compliant with electronic billing and invoicing systems across African countries

🌍 East Africa

🇰🇪 Kenya

Integrated with eTIMS (Electronic Tax Invoice Management System) by KRA for real-time invoice reporting

🇺🇬 Uganda

Compatible with EFRIS (Electronic Fiscal Receipting and Invoicing Solution) by URA

🇹🇿 Tanzania

Supports EFDMS (Electronic Fiscal Device Management System) by TRA

🇷🇼 Rwanda

Aligns with EIS (Electronic Invoicing System) by RRA

🇪🇹 Ethiopia

Ready for Electronic Invoicing System by Ethiopian Revenue Authority

🇧🇮 Burundi

Prepared for EBMS (Electronic Billing Management System)

🌍 West Africa

🇬🇭 Ghana

Integrates with E-VAT System by GRA for real-time software-based fiscalization

🇳🇬 Nigeria

Compliant with ATAS (Automated Tax Administration System) for electronic VAT

🇸🇳 Senegal

Prepared for mandatory Electronic Invoicing System implementation set for 2025

🇨🇮 Côte d'Ivoire

Ready for Electronic Fiscal Management System by Direction Générale des Impôts

🌍 North Africa

🇪🇬 Egypt

Advanced integration with Egyptian E-Invoicing System by ETA

🇲🇦 Morocco

Ready for Electronic Invoicing System by Direction Générale des Impôts

🇹🇳 Tunisia

Supports E-Invoicing Platform by Direction Générale des Impôts

🌍 Southern Africa

🇿🇦 South Africa

Supports SARS E-Invoicing practices with digital signatures and secure archiving

🇲🇺 Mauritius

Compliant with VAT Electronic System mandating electronic tax devices

🇧🇼 Botswana

Ready for Electronic Fiscal Device integration by BURS

Ready to Furnish Your Success?

Join hundreds of furniture retailers across Africa who trust BridgeERP to manage their showrooms, coordinate deliveries, and grow their furniture business.