Bring Joy to Your Toy Store with BridgeERP

Complete business management solution for toy retailers — from inventory to customer delight, all in one magical platform.

Complete Toy Business Management

From point-of-sale to inventory, customer relationships to seasonal planning - manage every aspect of your toy business with ease.

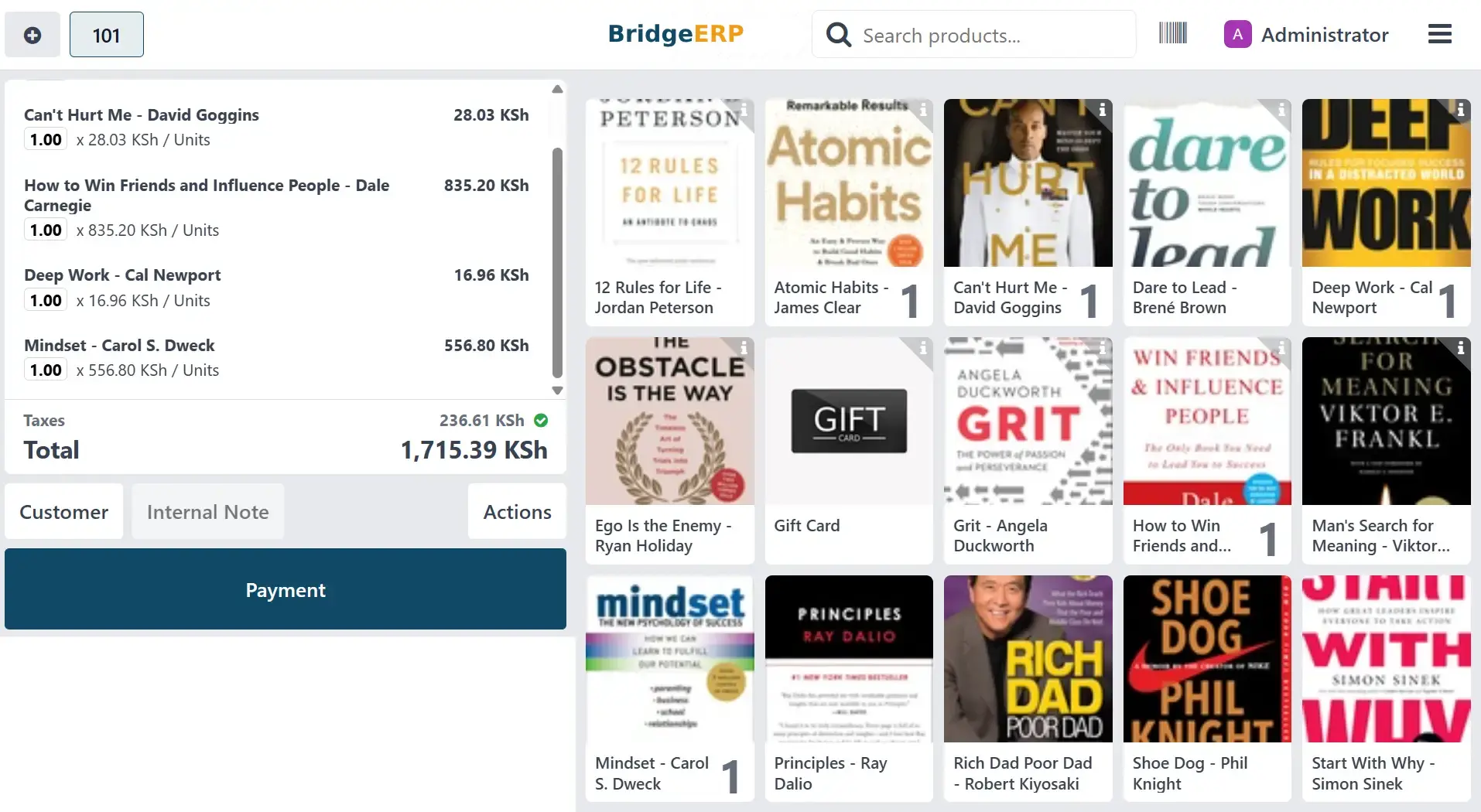

Smart Point of Sale and Customer Experience

Lightning-fast checkout with barcode scanning, age-appropriate recommendations, and gift wrapping options. Handle returns, layaways, and birthday registries seamlessly. Built-in customer database with children's ages and gift preferences.

- Barcode and product scanning

- Age-based product recommendations

- Gift wrapping and card services

- Birthday and wishlist management

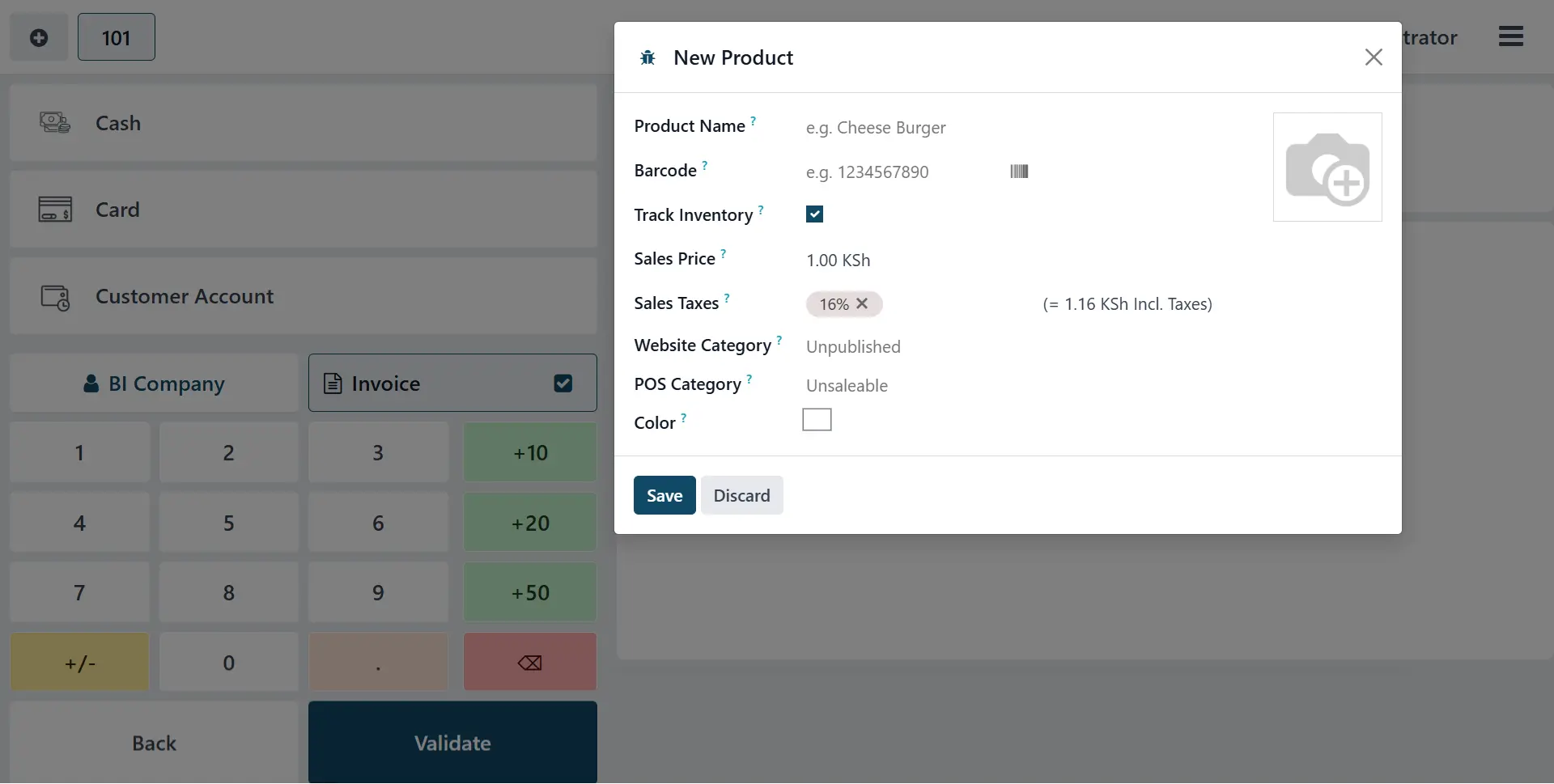

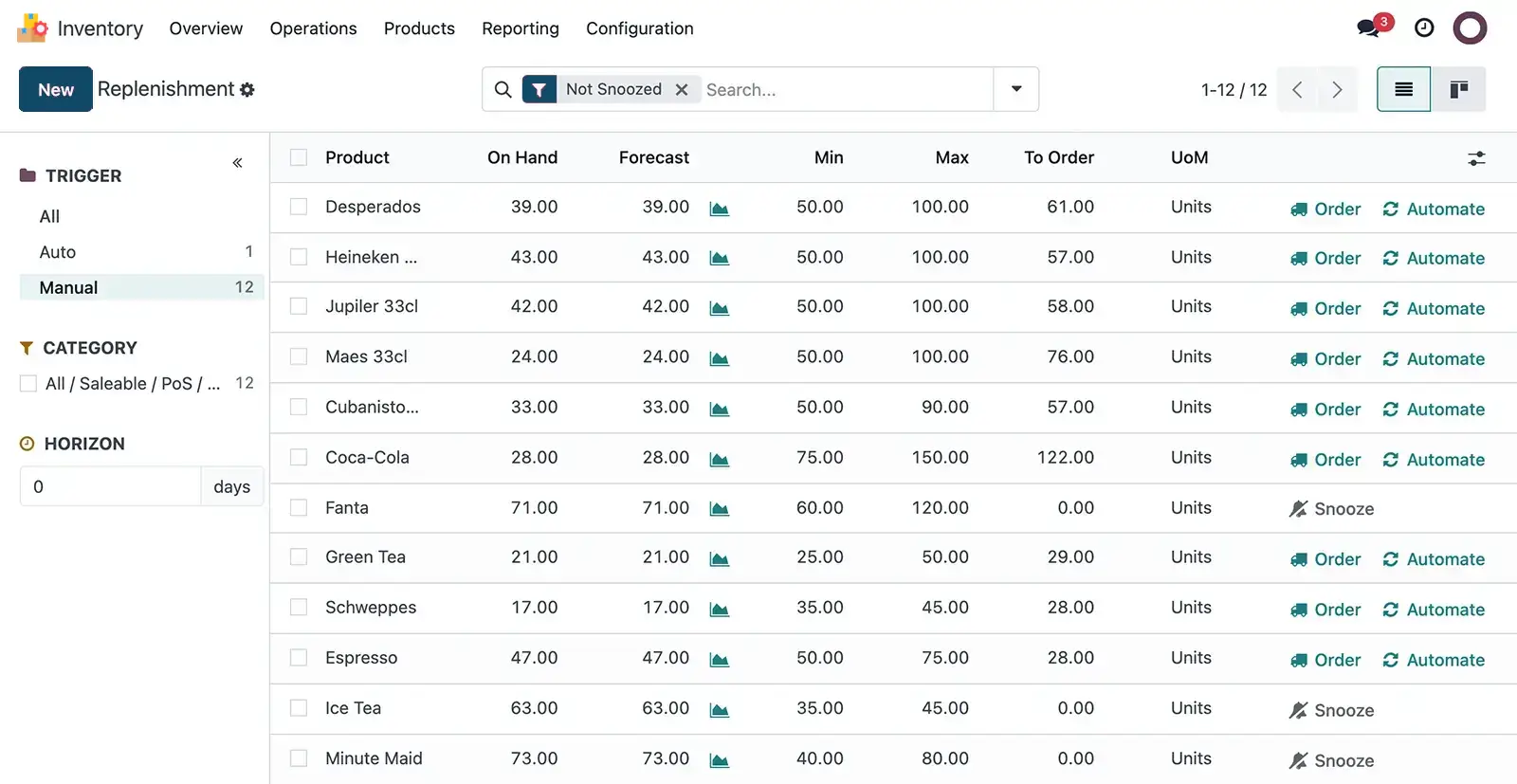

Seasonal Inventory and Warehouse Management

Real-time stock tracking with seasonal planning and trend forecasting. Handle product variants, bundle deals, and gift sets. Automated reordering with supplier integration and smart forecasting for holiday seasons.

- Seasonal demand planning

- Multi-location inventory

- Automated reorder points

- Product bundles and gift sets

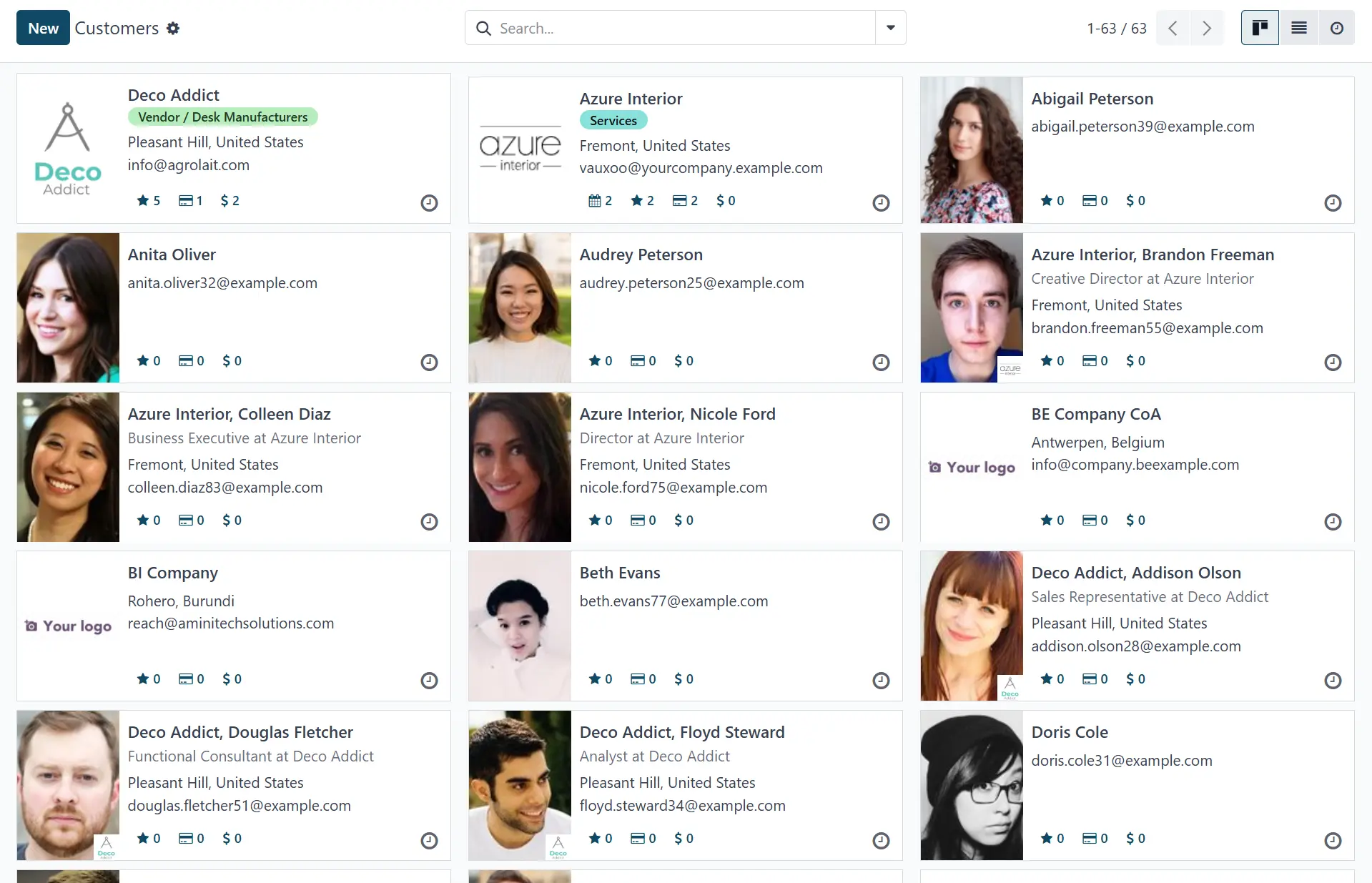

Family-Focused Customer Management

Build lasting relationships with comprehensive family profiles. Track children's ages, interests, and developmental milestones. Automated reminders for birthdays, holidays, and age-appropriate product launches.

- Family and children profiles

- Birthday and milestone tracking

- Loyalty programs and rewards

- Gift recommendation engine

Unified Online and Offline Toy Sales

Seamlessly sync your physical store with online channels. Handle click-and-collect, gift deliveries, and marketplace integration. Real-time inventory updates across all channels with special holiday promotions.

- Multi-channel selling

- Gift delivery scheduling

- Marketplace integration

- Holiday promotion management

Financial Management and Seasonal Reporting

Complete accounting suite with automated bookkeeping, tax compliance, and seasonal financial reporting. Track profitability by toy category, age group, and seasonal trends with detailed analytics.

- Automated bookkeeping

- Seasonal trend analysis

- Category profit margins

- Multi-currency support

Everything Your Toy Business Needs

Age-Based Categorization

Organize inventory by age groups and developmental stages for better customer recommendations

Gift Services Management

Handle gift wrapping, personalization, and delivery scheduling for special occasions

Seasonal Analytics

Track seasonal trends, holiday sales patterns, and age-group preferences

Multi-Store Management

Centralized control of multiple toy store locations with location-specific reporting

Birthday Marketing

Automated birthday reminders and personalized gift recommendations

Supplier Integration

Connect with toy manufacturers, distributors, and seasonal suppliers

Staff Training Tools

Product knowledge bases and age-appropriate recommendation training

Return Management

Handle returns, exchanges, and damaged goods with warranty tracking

Safety Compliance

Track product safety certifications and age-appropriate warnings

Layaway Management

Handle layaway plans for expensive toys and holiday purchases

Family Payment Plans

Accept installment payments for large purchases and birthday party packages

Event Management

Organize toy demonstrations, birthday parties, and seasonal events

Perfect for All Toy Retail Formats

Independent Toy Stores

Complete solution for specialty toy retailers

Educational Toy Specialists

Specialized tools for educational and developmental toys

Hobby and Game Stores

Manage collectibles, board games, and hobby supplies

Regional Tax Compliance Across Africa

Stay compliant with electronic billing and invoicing systems across African countries with built-in integrations

🌍 East Africa

🇰🇪 Kenya

Integrated with eTIMS (Electronic Tax Invoice Management System) by KRA for real-time invoice reporting and compliance

🇺🇬 Uganda

Compatible with EFRIS (Electronic Fiscal Receipting and Invoicing Solution) by URA for electronic invoice generation

🇹🇿 Tanzania

Supports EFDMS (Electronic Fiscal Device Management System) by TRA for electronic fiscal device integration

🇷🇼 Rwanda

Aligns with EIS (Electronic Invoicing System) by RRA for real-time electronic invoice issuance and reporting

🇪🇹 Ethiopia

Ready for Electronic Invoicing System implementation by Ethiopian Revenue and Customs Authority

🇧🇮 Burundi

Prepared for EBMS (Electronic Billing Management System) ensuring fiscal regulation compliance

🌍 West Africa

🇬🇭 Ghana

Integrates with E-VAT System by GRA for real-time software-based fiscalization with digital signatures

🇳🇬 Nigeria

Compliant with ATAS (Automated Tax Administration System) and Central Bank's e-invoicing for cross-border transactions

🇸🇳 Senegal

Prepared for mandatory Electronic Invoicing System implementation set for 2025 as per Finance Bill

🇨🇮 Côte d'Ivoire

Ready for Electronic Fiscal Management System by Direction Générale des Impôts for automated tax reporting

🌍 North Africa

🇪🇬 Egypt

Advanced integration with Egyptian E-Invoicing System by ETA with real-time validation and tracking

🇲🇦 Morocco

Ready for Electronic Invoicing System by Direction Générale des Impôts for B2B and B2G transactions

🇹🇳 Tunisia

Supports E-Invoicing Platform by Direction Générale des Impôts for electronic invoice submission

🇩🇿 Algeria

Compatible with Electronic Tax Declaration System by Direction Générale des Impôts

🌍 Southern Africa

🇿🇦 South Africa

Supports SARS E-Invoicing practices with digital signatures and secure archiving requirements

🇲🇺 Mauritius

Compliant with VAT Electronic System mandating electronic tax devices for transaction recording

🇧🇼 Botswana

Ready for Electronic Fiscal Device integration by Botswana Unified Revenue Service

🇿🇲 Zambia

Compatible with Electronic Fiscal Device System by Zambia Revenue Authority for real-time reporting

Ready to Transform Your Toy Business?

Join thousands of toy retailers across Africa who trust BridgeERP to manage their business operations and bring joy to families everywhere.