Transform your hair salon with the ultimate software solution

Bridge allows you to maximize sales across multiple channels, and keep your customers happy with rewards and discounts. Combined with seamless inventory tracking and easy invoicing, it's the perfect solution for your toy store!

Give it a try—it's free! Demo LinkUse the credentials below to log in:Username: demo Password: demo

Appointments Made Easy

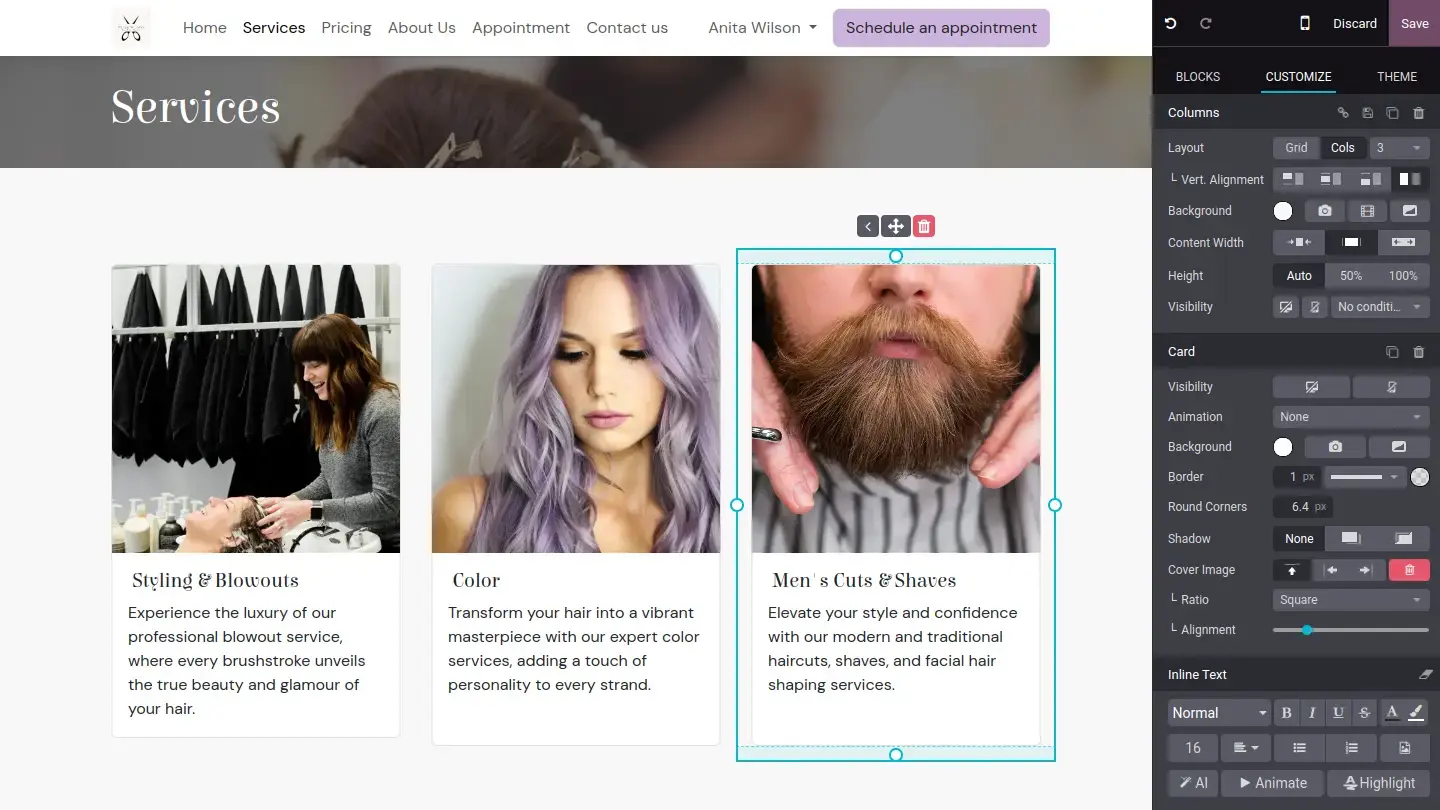

Custom website

builder

Allow clients to schedule and reschedule their appointments effortlessly. Enjoy seamless integration with Google Calendar, Outlook, or iOS for a smooth experience.

Minimize no-shows with automated reminders and advance payment options. Enhance your reputation by boosting online reviews through automated review requests.

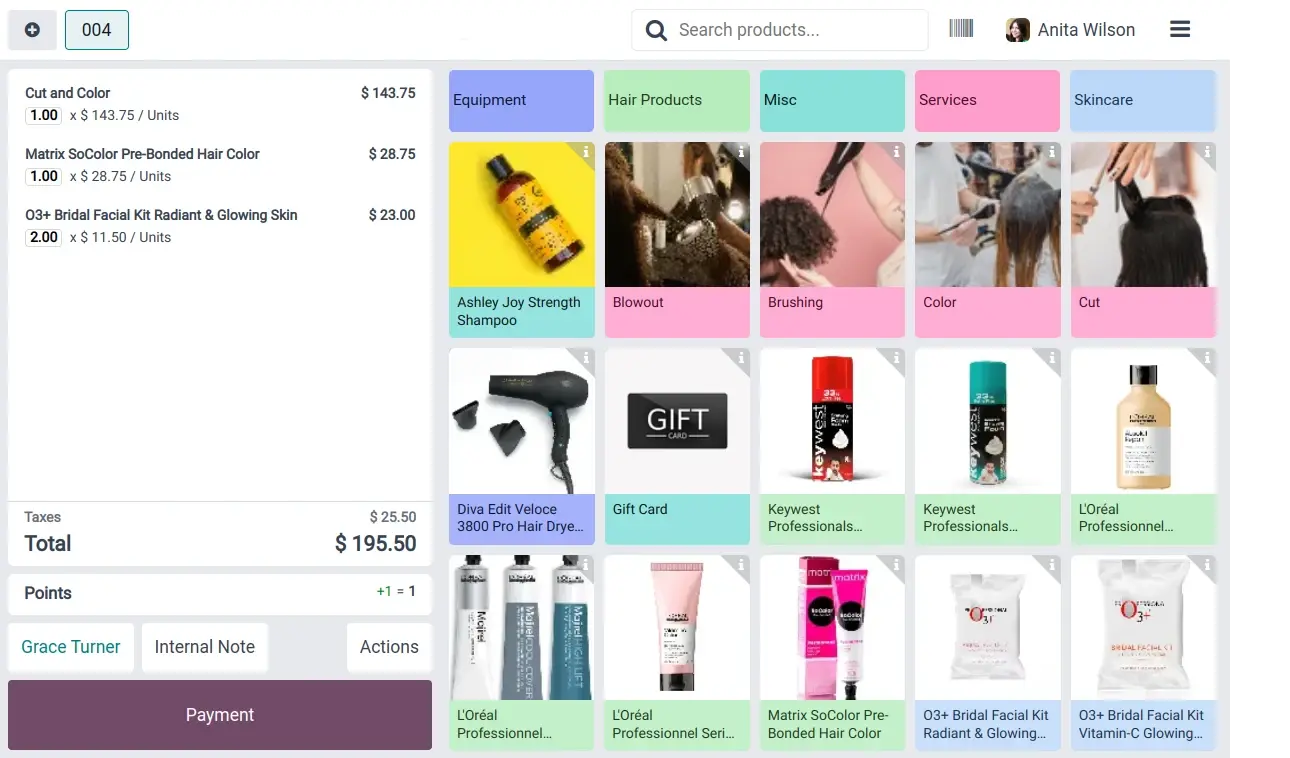

Effortless POS for Busy Salons

Quickly add extra services like conditioning, scalp massages, and other treatments during checkout for a seamless experience.

Create customizable loyalty programs where you control how clients earn points and what rewards they can redeem—whether it’s discounts, freebies, or other exclusive perks!

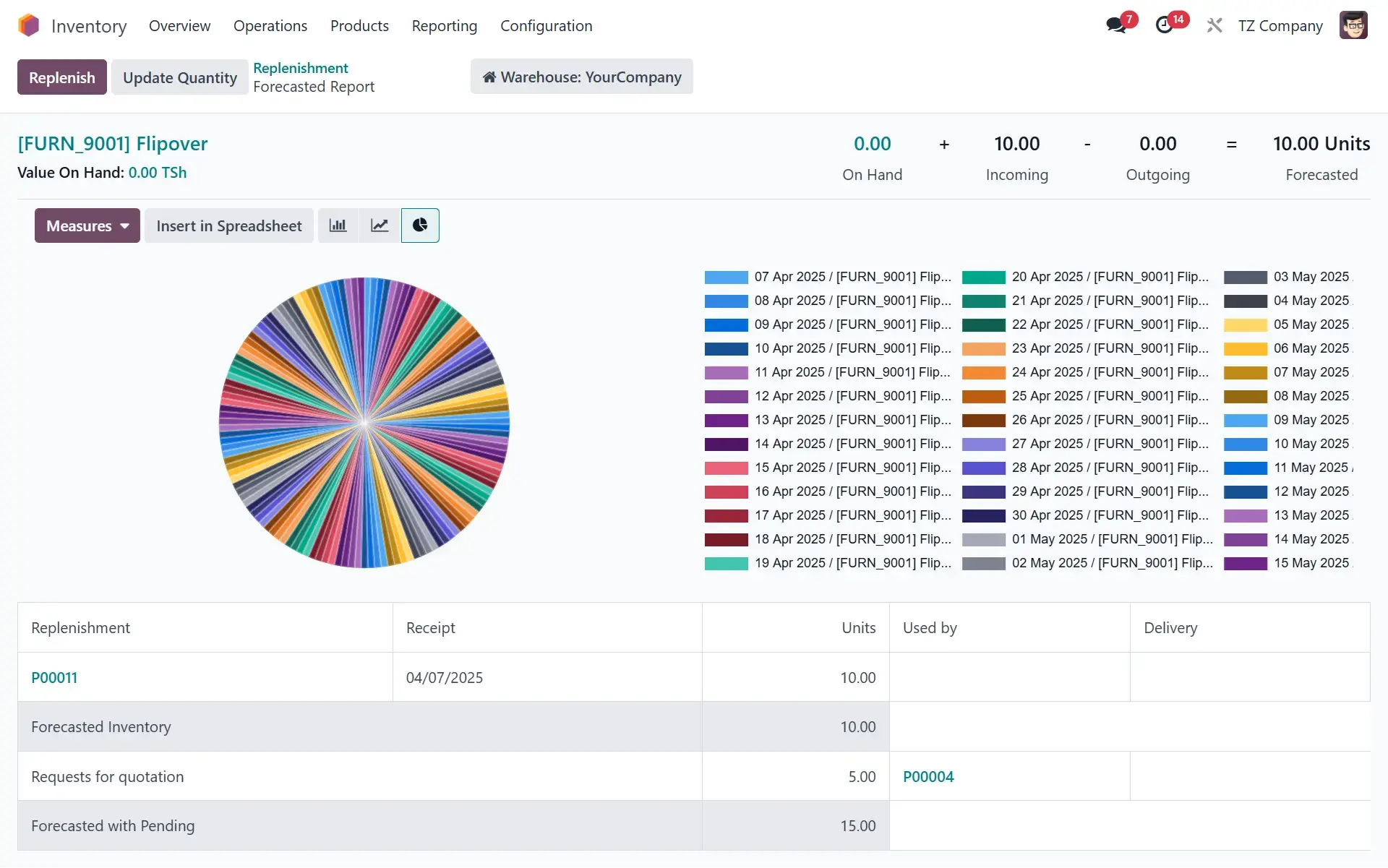

Inventory & Purchase Management

Stay on top of stock levels with real-time inventory tracking. BridgeERP allows you to manage bulk and perishable goods, automate reordering based on demand, and handle multi-location warehouses. Integrated purchase management ensures efficient supplier ordering, invoice matching, and cost tracking. Avoid stockouts or overstocking with intelligent forecasting and replenishment tools.

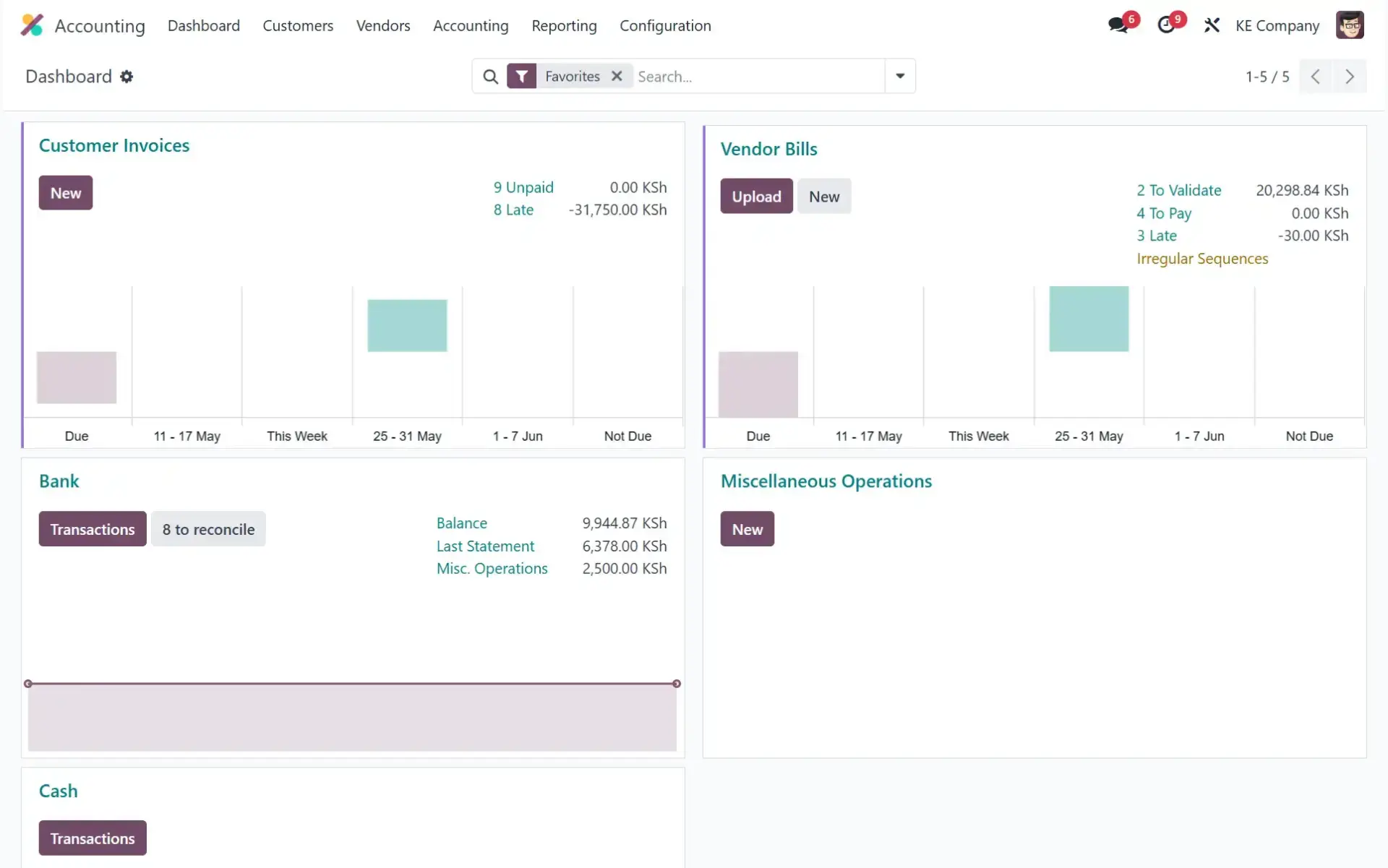

Accounting for a Supermarket

BridgeERP provides a powerful accounting module tailored for Salon business . Track income, expenses, taxes, and profitability in real-time. Automate daily journal entries from POS, manage supplier invoices, and reconcile bank transactions seamlessly. Multi-branch support ensures centralized financial visibility across locations, helping you stay compliant and profitable.

Kenya

Integrated with the Electronic Tax Invoice Management System (eTIMS) by the Kenya Revenue Authority (KRA), facilitating real-time invoice reporting and compliance.

Uganda

Compatible with the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) implemented by the Uganda Revenue Authority (URA), enabling electronic invoice generation and submission.

Burundi

Ready for EBMS (Electronic Billing Management System), ensuring businesses meet fiscal regulations and reporting standards.

Rwanda

Aligns with the Electronic Invoicing System (EIS) managed by the Rwanda Revenue Authority (RRA), ensuring real-time electronic invoice issuance and reporting.

Tanzania

Supports integration with the Electronic Fiscal Device Management System (EFDMS) overseen by the Tanzania Revenue Authority (TRA), allowing electronic fiscal devices to transmit transaction data directly to the tax authority.

Ghana

Integrates with the E-VAT system, a real-time, software-based fiscalization platform by the Ghana Revenue Authority (GRA). POS systems must be certified and connected via API, with transactions reported in real-time and receipts featuring digital signatures and QR codes .

South Africa

Supports e-invoicing practices regulated by the South African Revenue Service (SARS), which, while not mandatory, are widely adopted. The system emphasizes the integrity and security of invoices through digital signatures and strict archiving requirements .

Nigeria

Compliant with the Automated Tax Administration System (ATAS) for electronic VAT compliance, and supports the Central Bank of Nigeria's cross-border e-invoicing program for imports and exports .

Côte d’Ivoire

Supports integration with the Electronic Fiscal Device Management System (EFDMS) overseen by the Tanzania Revenue Authority (TRA), allowing electronic fiscal devices to transmit transaction data directly to the tax authority.

Senegal

Prepared for the upcoming mandatory electronic invoicing system set to be implemented in 2025, as outlined in the country's Finance Bill

Mauritius:

Compliant with VAT legislation that empowers the tax authority to mandate the use of electronic tax devices or invoicing systems for recording all transactions for tax purposes .

Egypt

Aligns with one of Africa's most advanced e-invoicing systems, requiring businesses to issue e-invoices that are tracked and validated by the Egyptian Tax Authority (ETA) .

All the features

done right.

Run everything from your mobile

Bridge ERP works seamlessly across mobile, tablet, and desktop, giving you flexibility no matter where you are!

Streamline purchasing

Receive purchased products directly into your inventory and automatically track your stock levels in real time.

Multiple Payment

Accept multiple payment methods: cash, Mobile Money, bank transfer, cheque, credit/debit card, or mobile wallets

Free Website

Free website for selling beauty products,

Barcode scanning

Easily add products to the cart in Point of Sale by scanning barcodes with a barcode scanner or your phone’s camera.

Track your finances

Create invoices, manage vendor bills, and track payments to maintain a clear and accurate view of your finances.